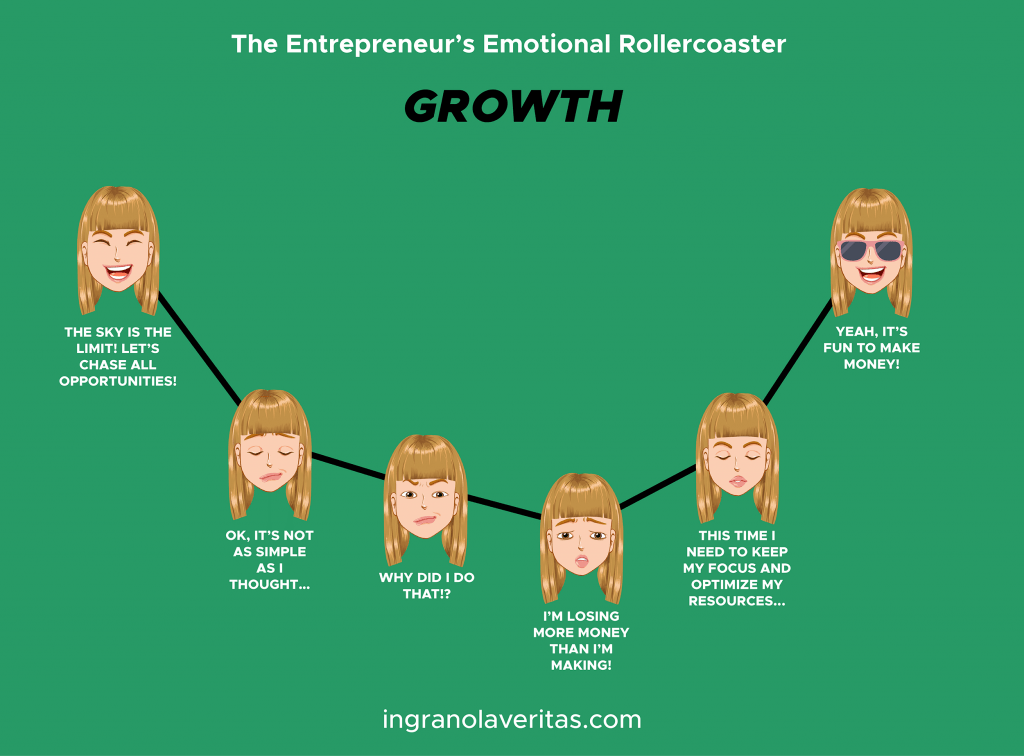

Growth is the main goal for any for-profit business. For some entrepreneurs, it even represents the ultimate objective. Yet, growth comes with its challenges and risks, which you need to be prepared for. Yes, growth can lead you to bankruptcy, and you must know how to anticipate the risks before they put your business in jeopardy.

What is organic growth?

Growth is the engine that allows a company to ensure a critical mass, i.e. the size from which the company can be profitable and thus validate its objective and the pursuit of its activities. In addition, profitable growth will enable the company to finance its working capital, investments, innovation, marketing, in short, its financial commitments…

It is therefore natural that a company seeks to grow in order to eventually reach the break-even point. But beyond this limit, which will be different depending on the nature of the company, the unrestrained quest for revenue growth can tip the balance of hard-earned profitability. The growth objective must therefore be clearly identified and circumscribed in order to optimize the resources that the company has at its disposal. But above all, we must anticipate the risks of this planned growth so as not to suffer the consequences.

When I first started, I remember repeatedly trying to establish my break-even point (the critical moment when the company generates enough sales to start making a profit) using sophisticated financial forecasting tools. Yet, my spending scenario was constantly changing, and my profit margin was erratic. Contingencies in production, fluctuations in material costs, salary increases, sales prices requested by the market or customers, etc.

So, I spent a lot of time trying to get to that unreachable dead spot, which means that I was in the red for a long time, i.e., losing money…a lot of money. For several years, I tried to limit the damage and I always believed that the following year would be better, but the losses were still accumulating, despite all my efforts and my huge desire to plug the leaks. Ironically, during this same period, my turnover was growing! I simply could not control my costs and increase my productivity accordingly, because my borrowed money was costing me a lot of interest. I would not generate enough working capital to finance my growth, and my profitability was anemic on the sales I was achieving. In addition, I finally understood that my monitoring tools were wrong and that trusting them was a bad idea…

Grow, but at what cost?

An important growth phase will require more daily attention and accurate monitoring. Do you know your break-even point or your dead point? In a phase of significant growth, these thresholds will change… continuously! It will be difficult to keep up. Be aware of it. You will also need to keep an eye on your staff and other resources that are quickly running out: erosion of financial resources (do you have a war chest?), rising wages, equipment breakdowns, injuries, burnouts, lack of motivation, fatigue and a higher risk of errors…

It will also be difficult to put out all fires, so you have to choose your battles and stay focused on the most promising opportunities in your development process. Choosing an axis of development is therefore essential. But each choice has its own difficulties and costs. Should we develop the offer or opt for more aggressive commercial development?

On the one hand, to enlarge the range is to support a larger inventory, to dilute its manufacturing and sales efforts on several products, and run the risk that the new products will not be that successful.

On the other side, commercial development is investing in sales and promotion costs. Geographic expansion often has a negative impact on profits. Can you afford it? You frequently have to invest a lot to start selling in a new market – are you strong enough to support unprofitable sales? If so, for how long? This kind of risk is measured and evaluated, so you need to be able to make the right decisions when the results do not match the effort.

You will need to plan for growth issues, associated costs, market development costs, selling costs, promotion levers, and contingency plans.

Opportunity or risk?

Unlike what is often said, seizing every opportunity is far from being a good idea. They are not all profitable and splitting them up does not allow you to seize them all effectively. So how should you qualify opportunities and keep the most promising opportunities (and give up or postpone others) while remaining in control of your risk-taking?

In my early days, I made the mistake many times of trying to wear all the hats in order to make my operations profitable. That made me lose a lot of money.

First of all, make sure the opportunity is sustainable. Is it significant enough to make you change your entire production line, just for this one shot? In many cases, a second order is not guaranteed. What repeat business, what success do you expect from a given client? What is your plan in case of failure, how many resources do you need to invest, and can you afford this financial loss (did you invest in fixed or variable fees)?

If the answer to any of these questions is “no”, learn to refuse an opportunity and not give in to the pressure or enthusiasm of your stakeholders: employees, shareholders, family… If you are not able to say no, read my article on the topic!